Building a Better Future for the Students of Lawrence County:

Building a Better Future for the Students of Lawrence County:

Funding the Construction and Renovation Needs for Our Schools

By Dr. Robbie Fletcher

Lawrence County Schools Superintendent

(This article is the third of a series that will cover topics pertaining to planning, remodeling, building, and financing school facilities in Lawrence County.)

In the previous two articles, I have provided information about the contents of our school system’s District Facilities Plan (DFP) and about the Local Planning Committee (LPC) who developed the plan after input from architects, engineers, and community members. As an update, the Lawrence County Schools’ DFP has been approved by the Lawrence County Board of Education and has been sent to the Kentucky Department of Education (KDE) for final approval. With their approval, the 2023 Lawrence County DFP becomes the plan that drives all construction projects in our school system for the next four years.

As outlined in previous articles, many renovations are listed at all schools in Lawrence County. The largest project is the construction of a new Louisa West Elementary that would contain preschool through second grade students. If you have recently visited the West, you certainly realize that replacing the building is necessary, even though the custodial and maintenance staff do an excellent job of cleaning and repairing. Unfortunately, building costs have increased tremendously over the past few years, and according to our architect consultants, a new Louisa West building would cost over $27 million.

That leads us to the BIG question: How will we pay for the new school AND the other priority items that are listed in the DFP?

The simple answer is “taxes that can be matched by the state government.” A more detailed answer deals with terms such as bonding potential, recallable nickel tax, and state equalization. Here is an explanation of each term and how it relates to our situation in Lawrence County:

• Bonding Potential: If you were to purchase a new home, you would likely go to a bank first to see how much money you could afford to borrow. For a school district, bonding potential refers to the amount of money that we can reasonably afford for one or more building projects over the next 20 years. According to our financial advisors at Ross, Sinclaire, and Associates, the Lawrence County School District can bond a maximum of $15 million without adding any additional taxes.

• Recallable Nickel Tax: In order to increase bonding potential, school districts can levy one or more additional nickel taxes to property owners. One nickel tax would add approximately 5 cents to every $100 of property value. For transparency, the nickel tax is calculated for each school district individually. Based on state calculations, the Lawrence County nickel tax would be around 6 cents per $100 of property value. According to information provided on the Kentucky Department of Education website, several districts in our region have the recallable nickel tax. Two of those districts include Paintsville and Martin County. The nickel tax in Paintsville is actually 5.4 cents per $100, while Martin County’s is 6.7 cents per $100.

• State Equalization: Every district that has passed the nickel tax has received equalization, or matching, funds from the state legislature. According to our financial advisors, one nickel tax would generate $5.75 million over the next 20 years from local tax payers. The state equalization (or money that would be GIVEN to Lawrence County Schools by the state legislature from the state budget) for one nickel tax would be $6.75 million over the next 20 years with the potential for even more. As a side note, I have personally spoken with state representatives, state senators, the governor, and even Rocky Adkins, who is an advisor to Governor Andy Beshear. According to Mr. Adkins and others, the state legislature will only consider providing these funds if the local district has the nickel tax.

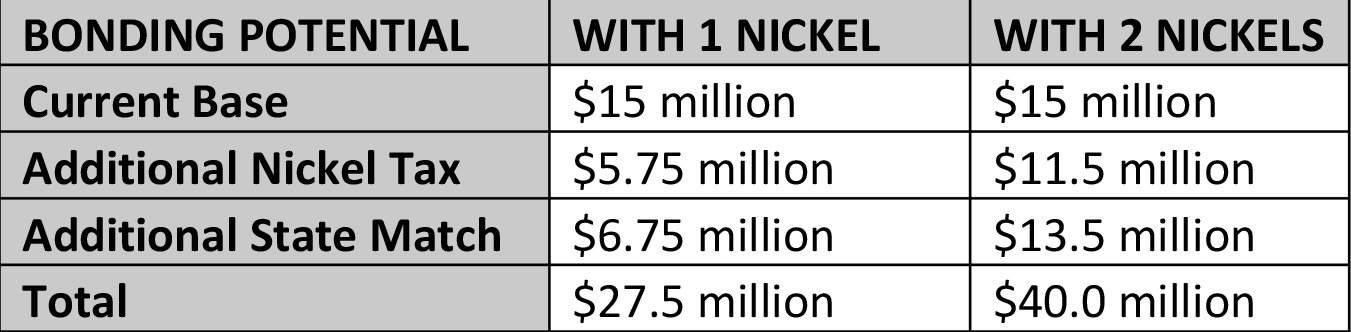

The following graph provides a summary of the Lawrence County bonding potential for the next 20 years, as provided by Ross, Sinclaire, and Associates financial advisors.

Lawrence County Schools’

Twenty-Year Bonding

Potential Summary

Here is another crucial question: Do we really need 2 additional nickels to replace Louisa West Elementary?

School officials were provided an estimate for the cost of a preschool – 2nd grade Louisa West by Ross Tarrant Architects. According to RTA, a new Louisa West would cost approximately $27 million, but that estimate does not include the cost of property or the cost of site preparation. Depending on the property, a new Louisa West would likely cost closer to $30 million. Keep in mind, we must address other needs within our district such as a new roof for Louisa Middle and other projects at Blaine, Fallsburg, Louisa East, and Lawrence County High School. Based on the information provided to us, two nickels with state equalization are needed to build a new Louisa West and to make necessary renovations to other schools.

My next article will focus on comparing tax rates in our region including recallable nickels, property tax, and motor vehicle taxes. Lord willing, I will publish Article #4 next week.

As always, let’s focus on building a better future for the students of Lawrence County. OUR STUDENTS ARE WORTH IT!

#AllinLC

Dr. Robbie Fletcher

606.638.9671

robbie.fletcher@lawrence.kyschools.us

All of the articles in the series can be found on our website:

https://www.lawrence.kyschools.us/documents/school-year-2022-2023/local-planning-committee/396589